July 1, 2006

Europe and the United States are on the verge of a very important decision about their plans to implement a common civil signal waveform at the L1 frequency: Should that waveform be pure binary offset carrier — BOC(1,1) — or a mixture of 90.9 percent BOC(1,1) and 9.09 percent BOC(6,1), a combination called multiplexed BOC (MBOC). The desire for a common civil L1 signal is enshrined in a 2004 agreement on GNSS cooperation between the United States and the European Union (EU).

Europe and the United States are on the verge of a very important decision about their plans to implement a common civil signal waveform at the L1 frequency: Should that waveform be pure binary offset carrier — BOC(1,1) — or a mixture of 90.9 percent BOC(1,1) and 9.09 percent BOC(6,1), a combination called multiplexed BOC (MBOC). The desire for a common civil L1 signal is enshrined in a 2004 agreement on GNSS cooperation between the United States and the European Union (EU).

For the EU and the European Space Agency (ESA), that decision — and its consequences — will come sooner: with the Galileo L1 Open Service (OS) that will be transmitted from satellites to be launched beginning in the next few years. For the United States, the waveform decision will shape the design of the L1 civil signal (L1C) planned for the GPS III satellites scheduled to launch in 2013. For a background on the process that led to design of the GPS L1 civil signal and its relevance to the BOC/MBOC discussion, see the sidebar L1C, BOC, and MBOC.

The May/June issue of Inside GNSS contained a “Working Papers” column titled, “MBOC: The New Optimized Spreading Modulation Recommended for Galileo L1 OS and GPS L1C”. Authored by members of a technical working group set up under the U.S./EU agreement, the article discussed the anticipated MBOC benefits, primarily improved code tracking performance in multipath. The column also noted that, while lower-cost BOC(1,1) receivers would be able to use MBOC, it would come at the cost of a reduction in received signal power.

An article in the “360 Degrees” news section of the same issue of Inside GNSS noted that some GNSS receiver manufacturers believe MBOC is not best for their applications and perhaps should not have been recommended. (This point was noted on page 17 of the May/June issue under the subtitle “MBOC Doubters.”) See the sidebar “Other Observers” (below) for additional comments from companies with concerns about MBOC recommendation.

This article, therefore, continues the discussion of a common signal waveform by asking several companies with different product perspectives whether they consider the proposed MBOC waveform to be more or less desirable for their applications than the BOC(1,1). Currently, BOC (1,1) is the baseline defined in the June 26, 2004, document signed by the U.S. Secretary of State and the vice-president of the European Commission (the EU’s executive branch): “Agreement on the Promotion, Provision and Use of Galileo and GPS Satellite-Based Navigation Systems and Related Applications.”

Maximum benefit from MBOC will be obtained by receivers using recently invented technology that employs computationally intensive algorithms. Although such receivers clearly will provide benefits to their users because of the BOC(6,1) component of MBOC, the practical value of the benefits have not been quantified, which is one purpose of the questions raised in this article. For the moment, let’s call all these prospective MBOC users “Paul”.

Meanwhile, patents on the most widely used multipath mitigation technologies today, such as the “narrow correlator” and the more effective “double-delta” techniques, will expire about the time the new signals are fully available, making these techniques more widely available. Unfortunately, the double-delta technology cannot use the BOC(6,1) component of MBOC. In addition, narrowband receivers, which today dominate consumer products, also cannot use the BOC(6,1). Let’s call all these users “Peter”.

Therefore, the fundamental question raised by this article is whether we should rob Peter to pay Paul. If the amount taken is quite small and the benefits are large, then the answer should be “yes.” If the amount taken creates a burden to Peter, now and for decades to come, with little benefit to Paul, then the answer should be “no.” The in-between cases are more difficult. The purpose of this article is to explore the tradeoffs.

To address this issue, we invited engineers from companies building a range of GNSS receivers to take part in the discussion. We’ll introduce these participants a little later. But first, let’s take a look at the technical issues underlying the discussion.

BOC/MBOC Background

The RF spectrum of a GPS signal is primarily defined by the pseudorandom code that modulates its carrier and associated data. A pseudorandom code appears to be a completely random sequence of binary values, although the sequence actually repeats identically, over and over.

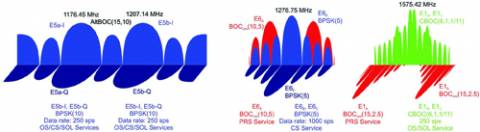

For the C/A code on the L1 frequency (1,575.42 MHz), the state of the code (either +1 or –1) may change at a clock rate of 1.023 MHz. We call this binary phase shift keying, or BPSK(1), meaning BPSK modulation with a pseudorandom code clocked at 1.023 MHz. Note that the bits of a pseudorandom code often are referred to as “chips,” and four BPSK chips are illustrated at the top of Figure 1. (To view any figures, tables or graphs for this story, please download the PDF version using the link at the top of this article.)

Among many other topics, the 2004 U.S./EU agreement settled on a common baseline modulation for the Galileo L1 OS and the GPS L1C signals: BOC(1,1). (The BOC(n,m) notation means a binary offset carrier with n being a 1.023 MHz square wave and m being a 1.023 MHz pseudorandom code.) Like BPSK(1), the BOC(1,1) waveform also is a BPSK modulation, meaning there are only two states, either a +1 or a –1. The timing relationships of the code and the square wave are illustrated by Figure 1.

Although the agreement defined BOC(1,1) as the baseline for both Galileo L1 OS and GPS L1C, it left the door open for a possible signal “optimization” within the overall framework of the agreement. As documented in the paper by G.W. Hein et al., “A candidate for the GALILEO L1 OS Optimized Signal” (cited in the “Additional Resources” section at the end of this article) and many other papers, the EC Signal Task Force (STF) after much study initially recommended a composite binary coded symbols (CBCS) waveform.

Because the agreement made it desirable for GPS L1C and Galileo L1 OS to have an identical signal spectrum and because GPS III implementation of CBCS would be difficult, a search was made by a joint EC/US working group to find an optimized signal that was acceptable for both GPS and Galileo. The result is MBOC (discussed in the May/June “Working Papers” column and the like-named IEEE/ION PLANS 2006 paper by G. W. Hein et al. cited in “Additional Resources.”).

Like all modernized GPS signals — including M-code, L2C, and L5 — L1C will have two components. One carries the message data and the other, with no message, serves as a pilot carrier. Whereas all prior modernized GPS signals have a 50/50 power split between the data component and the pilot carrier, L1C has 25 percent of its power in the data component and 75 percent in the pilot carrier.

The L1C MBOC implementation would modulate the entire data component and 29 of every 33 code chips of the pilot carrier with BOC(1,1). However, 4 of every 33 pilot carrier chips would be modulated with a BOC(6,1) waveform, as illustrated in Figure 2. The upper part of the figure shows 33 pilot carrier chips. Four of these are filled to show the ones with the BOC(6,1) modulation. Below the 33 chips is a magnified view of one BOC(1,1) chip and one BOC(6,1) chip.

The BOC(1,1) chip is exactly as illustrated in Figure 1 while the BOC(6,1) chip contains six cycles of a 6.138 MHz square wave. With this image in mind, we can easily calculate that the pilot carrier has 29/33 of its power in BOC(1,1) and 4/33 of its power in BOC(6,1). Because the pilot carrier contains 75 percent of the total L1C signal power, then the percent of total BOC(6,1) power is 75 × (4/33) or 9.0909+percent. Conversely, the data signal has 25 percent of the total L1C signal power; so, the calculation of BOC(1,1) power is 25 + 75 × (29/33) or 90.9090+ percent.

Because the Galileo OS signal has a 50/50 power split between data and pilot carrier, the implementation is somewhat different in order to achieve the same percentages of BOC(1,1) and BOC(6,1) power. For the most likely time division version of MBOC for Galileo, 2 of 11 chips in the pilot carrier would be BOC(6,1) with none in the data component. Thus, the percent of total BOC(6,1) power is 50 × (2/11) or 9.0909+ percent. Similarly, the percent of total BOC(1,1) power is 50 + 50 × (9/11) or 90.9090+ percent. This makes the spectrum of Galileo L1 OS the same as GPS L1C.

Code Transitions. The fundamental purpose of MBOC is to provide more code transitions than BOC(1,1) alone, as is evident in Figure 2. (A code loop tracks only the code transitions.) However, these extra transitions come on top of the increased number in BOC(1,1) compared to the L1 C/A signal.

Taking into account that the pilot carrier has either 75 percent of the signal power with GPS or 50 percent with Galileo, GPS with BOC(1,1) has 2.25 times more “power weighted code transitions” than C/A-code (a 3.5-dB increase). Galileo with BOC(1,1) has 1.5 times more (a 1.8-dB increase). MBOC on GPS would further increase the net transitions by another factor of 1.8 (2.6-dB increase), and the most aggressive version of MBOC on Galileo would increase the net transitions by a factor of 2.2 (3.4-dB increase).

Therefore, given the improvement of BOC(1,1) over C/A code, the question raised by this article is whether a further improvement in number of transitions is worth subtracting a small amount of signal power during all signal acquisitions, for all narrowband receivers, and for all receivers using the double-delta form of multipath mitigation.

A portion of Table 1 from the May/June “Working Papers” column is reproduced here, also as Table 1. Of the eight possible waveforms in the original table, only three are included here. These are representative of all the options, and they include the two versions of MBOC considered most likely for implementation in Galileo and the only version GPS would use.

Two new columns have been added in our abbreviated version of the table. The first is an index to identify the particular option, and the last identifies whether GPS or Galileo would use that option.

Receiver Implementations

Most GNSS receivers will acquire the signal and track the carrier and code using only the pilot carrier. For GPS L1C this decision is driven because 75 percent of the signal power is in the pilot carrier. Little added benefit comes from using the data component during acquisition and no benefit for code or carrier tracking, especially with weak signals.

For Galileo, the decision is driven by the data rate of 125 bits per second (bps) and the resulting symbol rate of 250 symbols per second (sps). This allows only 4 milliseconds of coherent integration on the Galileo data component (compared with 10 milliseconds on the GPS data component). Because coherent integration of the pilot carrier is not limited by data rate, it predominantly will be the signal used for acquisition as well as for carrier and code tracking.

Reflecting the reasons just stated, Figure 3 compares the spectral power density in the pilot carrier for each of the three signal options listed in Table 1. In each case the relevant BOC(1,1) spectrum is shown along with one of the three MBOC options. These plots show power spectral density on a linear scale rather than a logarithmic dB scale, which renders small differences more prominent.

The center panel shows the GPS case with either BOC(1,1) or TMBOC-75. (The BOC(1,1) peaks are arbitrarily scaled to reach 1.0 Watt per Hertz (W/Hz). The BOC(1,1) peaks of TMBOC-75 are lower by 12% (-0.6 dB) in order to put additional power into the BOC(6,1) component of TMBOC-75, primarily at ±6 MHz.

All three panels of Figure 3 have the same relative scaling. The reason the peaks of the BOC(1,1) components in panels 1 and 3 are at 0.67 W/Hz is that GPS L1C will transmit 75 percent of its total signal power in the pilot carrier whereas Galileo will transmit 50 percent. The difference is simply 0.5/0.75 = 0.67 (-1.8 dB).

The first panel of Figure 3 also shows the Galileo TMBOC-50 option in which the BOC(1,1) component peaks are lowered by 18 percent (-0.9 dB) in order to provide power for the BOC(6,1) component, primarily at ±6 MHz.

The third panel shows the same Galileo BOC(1,1) power density but with the CBOC-50 option. In this case the BOC(6,1) component exists in the data channel as well as the pilot carrier. That is why it is half the amplitude at ±6 MHz as in panels 1 and 2. That also is why less power is taken from the BOC(1,1) component for the BOC(6,1) component; in this case the reduction is 9 percent (-0.4 dB). This is not considered an advantage by those who want to track the BOC(6,1) component, and it also reduces the data channel power for narrowband receivers by the same 9 percent or 0.4 dB.

As stated before, the fundamental question raised by this article is whether we should rob Peter to pay Paul. As with all such top-level questions, the answers lie in the details and in the perceptions of those affected. Inside GNSS posed a series of questions to industry experts in order to explore their perspectives and preferences.

The Questions and Answers

Q: What segment of the GNSS market do your answers address? Describe your market, including typical products and the size of the market.

Fenton – High precision survey and mapping, agriculture/machine control, unmanned vehicles, scientific products, and SBAS ground infrastructure where centimeter accuracy is very important. NovAtel sells at the OEM level to software developers and system integrators and calculates its present total addressable market (TAM) at $300-$400 million USD, again at the OEM level.

Garin – We are focused on consumer electronics where very low cost and very low power are of critical importance, such as personal navigation devices (PNDs), cellular phones, and in general applications where the power consumption is at a premium. These objectives should be reached with little to no impact on the user experience. The loss of performance due to design tradeoffs is mitigated by assisted GPS (A-GPS).

Hatch /Knight – NavCom supplies high-precision, multi-frequency GNSS receivers that employ advanced multipath and signal processing techniques, augmented by differential corrections from our StarFire network. These receivers are widely used in the agriculture, forestry, construction, survey, and offshore oil exploration markets. Current market size is on the order of 100,000 units per year.

Sheynblat/Rowitch – Our answers address wireless products for the consumer, enterprise, and emergency services markets. There are over 150 million Qualcomm GPS enabled wireless handsets in the market today, and this large market penetration and heavy usage is primarily driven by low cost, low power, and high sensitivity. The vast majority of other GPS enabled consumer devices worldwide are also cost driven.

Stratton – Rockwell Collins is a leading provider of GPS receivers to the U.S. military and its allies, and we are also a major supplier of GNSS avionics to the civil aviation industry. The civil aviation applications demand high integrity and compatibility with augmentation systems, while the military requirements range from low-power, large-volume production to high-dynamic and highly jam-resistant architectures (as well as civil compatible receivers). Military receivers are impacted due to civil compatibility requirements. Our company has produced over a half million GPS receivers and has a majority market share in military and high-end civil aviation (air transport, business, and regional) markets.

Studenny – Our market is commercial aviation where continuity of operation and integrity are the most important performance parameters.

Weill – I and a colleague, Dr. Ben Fisher, of Comm Sciences Corporation, are the inventors of a new multipath mitigation approach which we call Multipath Mitigation Technology (MMT), so our primary product is technology for improved multipath mitigation. MMT is currently incorporated in several GPS receivers manufactured by NovAtel, Inc. Their implementation of MMT is called the Vision Correlator.

Q: Which signal environments are important for your products: open sky, indoor, urban canyon, etc.

Fenton – In general, most of our customers operate in open sky environments. However, a significant number are operating under or near tree canopy and in urban canyons.

Garin – Ninety percent of our applications are or will be indoors and in urban canyons.

Hatch /Knight – Our receivers are mostly used in open sky and under-foliage conditions.

Stratton – Our products use civil signals mainly in open sky conditions, although civil signals may be used to assist the acquisition of military signals in a broad variety of environments.

Studenny – Aircraft environments, with particular attention to safety-of-life. Also, ground-based augmentation system (GBAS) ground stations.

Weill – Any environment in which multipath is regarded as a problem, including precision survey, indoor (911) assisted GPS, and military and commercial aviation.

Q: Which design parameters are most critical for your products: power, cost, sensitivity, accuracy, time to fix, etc.

Fenton – In general, our products service the high end “commercial” markets. Our customers in general have priorities in the following order: a) accuracy, b) robust tracking, c) cost, d) power, e) time to first fix.

Garin – The most important criteria are, from the highest to the lowest: power, cost, sensitivity, time-to-first-fix, and finally, accuracy.

Hatch /Knight – Accuracy is most important.

Sheynblat/Rowitch – We have invested substantial engineering effort to achieve market-leading sensitivities (-160 dBm) while maintaining very low receiver cost. Engineering investment, focus on sensitivity, and close attention to cost models is probably also true for other vendors focused on mass market, AGPS enabled devices that have to work indoors. All of these GPS vendors go to great lengths to improve sensitivity for difficult indoor scenarios. Every dB counts and may make the difference between a successful or a failed fix, which is of particular concern for E-911 and other emergency situations.

Stratton – The tradeoff in relative importance of these parameters varies widely depending on the particular application, though life-cycle cost (including development and certification) arguably is most significant.

Studenny – Actually, all parameters are important. However, we focus on safety-of-life and the drivers are both continuity of operation and integrity (hazardously misleading information or HMI).

Specifically, we believe cross-correlation, false self-correlation, and the ability to resist RFI, as well as improving multipath performance, are signal properties of great interest to us. A well-selected coding scheme minimizes all of these and HMI in particular. Finally, HMI may become a legal issue for non-aviation commercial applications, especially if those applications involve chargeable services, implied safety-of-life, and other such services.

Weill – MMT is most effective in receivers that have high bandwidth and are receiving high-bandwidth signals. However, it can substantially improve multipath performance at lower bandwidths.

Q: Do you really care whether GPS and Galileo implement plain BOC(1,1) or MBOC? Why?

Fenton – Yes, we expect that the MBOC signals combined with the latest code tracking techniques will provide a majority of our customers a significant performance benefit for code and carrier tracking accuracy in applications where multipath interference is a problem.

Garin – I do not believe that MBOC will significantly benefit our short-term market. The MBOC expected multipath performance improvement will be meaningless in the urban context, where the dominant multipath is Non Line of Sight and where the majority of the mass market usage is concentrated. However we believe that a carrier phase higher accuracy mass market will emerge within a 5 year timeframe, with back-office processing capabilities, and wireless connected field GPS sensors. This will be the counterpart of the A-GPS architecture in cell phone business. MBOC would have an important role to play in this perspective. We envision this new market only in benign environments, and not geared towards the surveyors or GIS professionals.

Hatch /Knight – The MBOC signal will significantly improve the minimum code tracking signal to noise ratio where future multipath mitigation techniques are effective. The expected threshold improvements will be approximately equal to the best case improvements indicated by this article. MBOC will be less beneficial to very strong signals where the noise level is already less than the remaining correlated errors, like troposphere and unmitigated multipath.

Designing a receiver to use the MBOC code will be a significant effort. The resulting coder will likely have about double the complexity of the code generator that does not support MBOC. There will be a small recurring cost in silicon area, and power consumption will increase significantly. Overall, MBOC is desirable for our high performance applications. For many applications the costs are greater than the benefits.

Sheynblat/Rowitch – Yes, we do care about the decision of BOC versus MBOC. The proposed change to the GPS L1C and Galileo L1 OS signal to include BOC(6,1) modulation will perhaps improve the performance of a very tiny segment of the GPS market (high cost, high precision) and penalize all other users with lower effective received signal power due to their limited bandwidth. We prefer that GPS and Galileo implement the BOC(1,1) signal in support of OS location services.

Stratton – This decision does not appear to have much influence on our markets when viewed in isolation, but we would like to see GPS make the best use of scarce resources (such as spacecraft power) to provide benefits that are attainable under realistic conditions.

Studenny – Yes, we do care. GPS L5 needs to be complemented by a signal with similar properties at L1, the reason being that a momentary outage during precision approach on either L1 or L5 should not affect CAT-I/II/III precision approach continuity or integrity. We understand that there are constraints in selecting a new L1 signal; however the proposed MBOC waveform better supports this. This is keeping with supporting the FAA NAS plans and transitioning to GNSS for all phases of flight including precision approach.

Weill – Yes. Comm Sciences has established that the performance of current receiver-based multipath mitigation methods is still quite far from what is theoretically possible. It is also known that GNSS signals with a wider RMS bandwidth have a smaller theoretical bound on ranging error due to thermal noise and multipath. Since multipath remains as a major source of pseudorange error in GNSS receivers, I feel that the use of an MBOC signal for GPS and Galileo is an opportunity to provide the best possible multipath performance with evolving mitigation methods that take advantage of the larger RMS bandwidth of an MBOC signal as compared to plain BOC(1,1).

Q: Are the GNSS receivers of interest narrowband (under ±5 MHz) or wideband (over ±9 MHz)?

Fenton – Wideband. High precision GNSS receivers typically process all available bandwidth ~20 MHz (±10 MHz).

Garin – Our GNSS receivers are narrowband today, but we expect the widening of the IF bandwidth (or equivalently their effective bandwidth) to ±9 MHz, in the next 3-5 years, with the same or lower processing and power consumption.

Hatch /Knight – Our receivers are primarily wideband.

Sheynblat/Rowitch – The receivers of interest are narrowband. Low cost GPS consumer devices do not employ wideband receivers today and will most likely not employ wideband receivers in the near future. Any technology advances afforded by Moore’s law will likely be used to further reduce cost, not enable wideband receivers. In addition, further cost reductions are expected to expand the use of positioning technology in applications and markets which today do not take advantage of the technology because it is considered by the manufacturers and marketers to be too costly.

Stratton – All of our markets require wide-band receivers; however, the civil receiver/antenna RF characteristics are adapted to high-bandwidth C/A processing (where the bulk of RF energy is at band center). So the MBOC signal does raise some potential compatibility questions.

Studenny – Wideband.

Weill – I believe the trend will be toward wideband receivers for most applications. If one looks at the history of GPS receiver products, it is clear that there has always been competitive pressure to increase positioning accuracy, even at the consumer level. Not only is better accuracy a marketing advantage, but it has also opened up entirely new applications. The availability of wide bandwidth signals is a key factor in continuing to improve positioning accuracy. Although currently available receivers that can take advantage of wider bandwidth signals cost more and consume more power, the rapid rate of improving digital technology should make low-cost, low-power, wide bandwidth receivers available in the not-so-distant future. The availability of an MBOC signal would maximize the capability of such receivers.

Other Observers

Inside GNSS invited comments from a broad range of companies representative of most GNSS markets. In addition to those who fully responded to our questions, several offered abbreviated remarks:Garmin International, Inc. did not identify a spokesperson, but it submitted the following official statement: “It is Garmin’s policy not to disclose any information about future designs. However, we would like to indicate that we support the BOC(1,1) implementation over the MBOC.”Sanjai Kohli, Chief Technology Officer of SiRF Technology Inc., submitted the following official statement: “The existence of the BOC(6,1) chips in the MBOC signal won’t matter very much to SiRF. Still, to maximize the availability of weak signals, it would be preferable not to suffer any loss of signal power. Therefore, SiRF would prefer that all chips be BOC(1,1). Furthermore, it is doubtful that any advanced method of multipath reduction will be of much benefit for urban and indoor signal reception, since it is likely that the line-of-sight component of the weak signal is blocked.”

European Company – A large and well known European consumer products company could not obtain internal approval to answer the questions, but the following unofficial communication from a technical manager is of interest: “Our understanding about the pros and cons of MBOC as compared with BOC(1,1) is . . . that narrow-band receivers are not able to utilize the higher frequency components of the MBOC signal and they thus represent wasted power from their viewpoint. This is especially true for acquisition, because the acquisition bandwidth many times seems to be narrower than the tracking bandwidth, especially in those parallel acquisition receivers that are used in consumer products specified for weak signal operation. For such receivers the received signal power is critical in the acquisition phase, not so much in the tracking phase.”

L1C, BOC, and MBOC

Pertinent to the subject of this article is the remarkable way in which the L1C signal was designed. The original C/A- and P-code signals were designed by a small group of technologists under the direction of the GPS Joint Program Office (JPO). Although from the beginning GPS was understood to be a dual-use (civil and military) system, the signals were designed primarily from a military perspective.

Design of the L2C civil signal was led by a JPO deputy program manager representing the Department of Transportation (DoT) — but the process took place under extreme time pressure. The RTCA, Inc., with authorization from the Federal Aviation Administration (FAA), initially defined the L5 signal. The RTCA is a consensus-driven open forum, but its focus is almost exclusively on aviation.

In contrast, development of L1C was funded by the Interagency GPS Executive Board (IGEB), now superseded by the National Space-Based Positioning, Navigation, and Timing (PNT) Executive Committee. Representatives of the Department of Defense (DoD) and DoT co-chair the PNT Executive Committee: so, the central focus is on managing GPS as a dual-use utility. Reflecting this, the L1C project was co-chaired by a DoD representative and by a civil representative. (The civil co-chair was Dr. Ken Hudnut of the U.S. Geological Survey. A sequence of JPO officers represented the DoD: Captains Bryan Titus, Amanda Jones, and Sean Lenahan. Tom Stansell of Stansell Consulting served as project coordinator throughout.)

L1C development consisted of two key activities. The first was a study of the wide range of civil requirements and development of five signal structure options. A technical team conducted this part of the work, drawing on experts in all aspects of the signal, including spreading code, data modulation, forward error correction, and message format.

Several team members had deep experience developing civil user equipment, from consumer chipsets to high-precision survey receivers. Others were experts on aviation requirements. The second key activity is, to our knowledge, unique: a worldwide survey of GNSS experts to determine which of the five options to choose. The design process is complete, and a draft specification (IS-GPS-800) has been published.

The innovative MBOC proposal was developed quickly by a group of very competent U.S. and EU signal experts with both civil and military backgrounds. However, this team apparently had only one person with extensive experience in receiver manufacturing, and the timeline did not allow the opportunity for a broad survey to assess equipment manufacturers’ opinions about the design. Informal conversations with some industry representatives also revealed dissatisfaction with MBOC. Therefore, Inside GNSS decided to consult a number of experts from companies that build GNSS equipment to determine their thoughts about the MBOC concept.

Additional Resources

1. Agreement on the Promotion, Provision and Use of Galileo and GPS Satellite-Based Navigation Systems and Related Applications, June 26, 2004, http://pnt.gov/public/docs/2004-US-EC-agreement.pdf

2. Hein, G. W., and J-A. Avila-Rodriguez, L. Ries, L. Lestarquit, Issler, J. Godet, and T. Pratt, “A candidate for the GALILEO L1 OS Optimized Signal”, Proceedings of ION GNSS 2005 – 13-16 September 2005, Long Beach, California

3. Hein, G. W., and J-A. Avila-Rodriguez, S. Wallner, J. W. Betz, C. J. Hegarty, J. J. Rushanan, A. L. Kraay, A. R. Pratt, S. Lenahan, J. Owen, JL. Issler, T.A. Stansell, “MBOC: The New Optimized Spreading Modulation Recommended for Galileo L1 OS and GPS L1C”, Inside GNSS, Volume 1, Number 4, pp 57–65, May/June 2006

4. Hein, G. W., and J-A. Avila-Rodriguez, S. Wallner, A. R. Pratt, J. Owen, J-L. Issler, J. W. Betz, C. J. Hegarty, S. Lenahan, J. J. Rushanan, A. L. Kraay, T.A. Stansell, “MBOC: The New Optimized Spreading Modulation Recommended for GALILEO L1 OS and GPS L1C”, IEEE/ION PLANS 2006, April 24-27, 2006, San Diego, California

5. IS-GPS-200: NAVSTAR GPS Space Segment / Navigation User Interfaces; IS-GPS-705: NAVSTAR GPS Space Segment / User Segment L5 Interfaces; Draft IS-GPS-800 for new L1C signal; http://gps.losangeles.af.mil/engineering/icwg/

By